But all of a sudden, it signs a contract that requires another five paid customer service reps. Likewise, let's say a startup e-commerce business pays for warehouse space to manage its inventory and 10 customer service employees to handle order inquiries. These expenses are your fixed costs, and no matter what adjustments you make to your schedule, you pay the same price. Expenses like groceries, petrol expenditures, and childcare will increase if you have children, and these expenses are your variable costsĪlthough your variable costs escalate after having a family, for as long as you are in the same home and ride the same vehicle, your monthly mortgage, utility bill, travel expenses, and car payment do not change. As an adult, you may need to pay a monthly rent or contract, electric bill, vehicle payment, housing, travel costs, and groceries. Think of the variable cost and fixed cost this way. Goods' materials and facilities are examples of variable costs. On the other hand, variable cost is business expenses that can vary depending on demand or revenues. Thus, as these costs vary, it is advised to measure only the fixed costs in the short term.įixed cost is one of the two main contributors to the overall production cost. Your operating expenses will increase, but this increase is not related to production or revenue. Your landlord, for instance, can raise the lease on your office. Although the amount of money linked with fixed costs may not vary based on sales, they will increase or decrease depending on other variables. Total fixed cost, or the overall expense of every kind of fixed costs, is usually calculated over a short period of time, for example, a month or half a year. Rent fees, insurance, and staff' salary are some examples of fixed costs.

Instead, fixed cost is usually set by an external body like a property owner or bank. The business cannot change their fixed costs even if they decide to decrease operating expenses. Fixed costs are also referred to as indirect costs or overhead. Fixed cost is independent of the number of business activities because it is more of a periodic cost. What is fixed cost?įixed cost is the expense that does not change in tandem with changes in demand or revenue over a certain period of time. Without further ado, here is the definition.

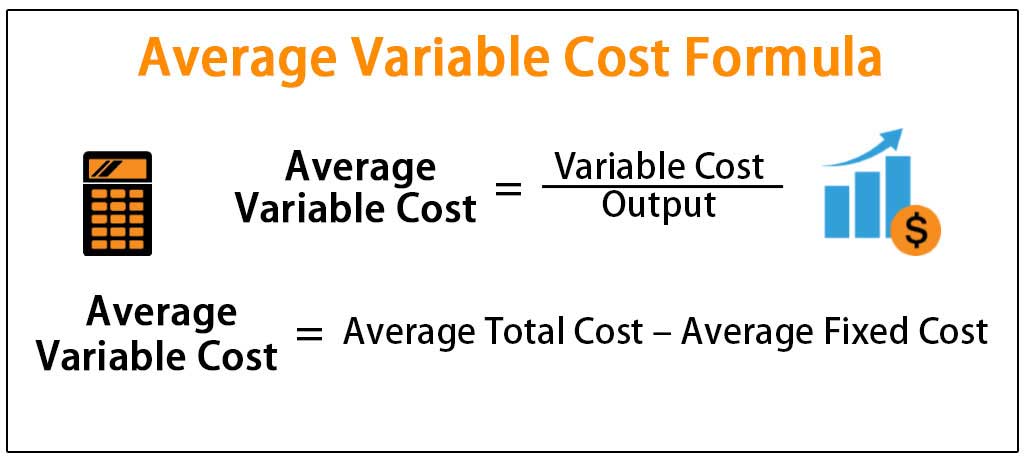

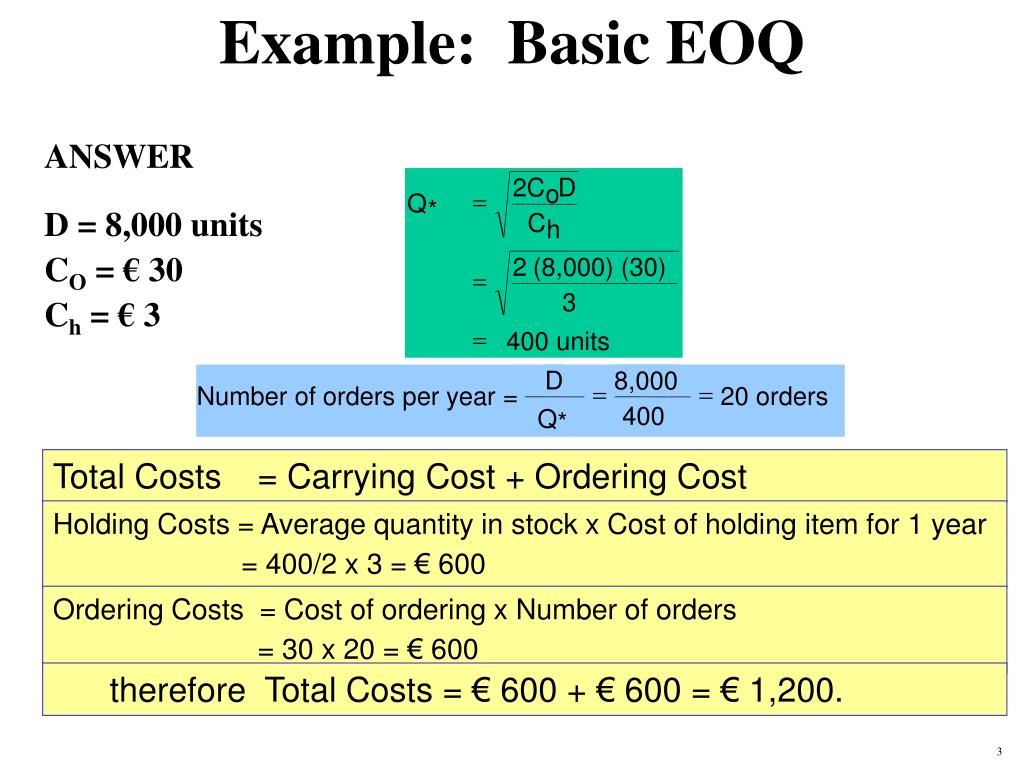

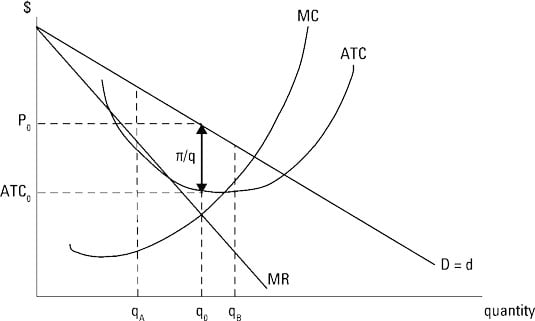

In this article, you will learn about fixed costs, how total fixed costs and average fixed cost can be measured, examples of fixed cost, as well as pros and cons of fixed cost. Understanding fixed cost is of great importance for companies to price their goods or services reasonably. Thus, the cost per unit is not constant.All businesses must face different kinds of costs throughout their operation, which can be grouped into fixed cost or variable cost. The cost per unit should decline as the number of units produced increases, primarily because the total fixed costs will be spread over a larger number of units (subject to the step costing issue noted above). (Total fixed costs + Total variable costs) ÷ Total units produced Within these restrictions, then, the cost per unit calculation is: This is a prudent choice when the need for increased capacity is not clear. Depending on the size of the step cost increase, a manager may want to leave capacity where it is and instead outsource additional production, thereby avoiding the additional fixed cost. When a step cost is incurred, the total fixed cost will now incorporate the new step cost, which will increase the cost per unit. Examples of step costs are adding a new production facility or production equipment, adding a forklift, or adding a second or third shift. Fixed costs, such as building rent, should remain unchanged no matter how many units are produced, though they can increase as the result of additional capacity being needed (known as a step cost, where the cost suddenly steps up to a higher level once a specific unit volume is reached). Variable costs, such as direct materials, vary roughly in proportion to the number of units produced, though this cost should decline somewhat as unit volumes increase, due to greater volume discounts. The cost per unit is derived from the variable costs and fixed costs incurred by a production process, divided by the number of units produced. Cost per unit information is needed in order to set prices high enough to generate a profit.

0 kommentar(er)

0 kommentar(er)